Strategy to 2025

2020 marked the beginning of a new strategic cycle, with the Strategy to 2025 approved by the Company in 2019. The new strategic cycle envisages construction of hi-tech production sites and ramp-up of fertilizer output to 11.7 mln t. Achieving this goal would be impossible without long-term investments in both expansion of production capacities and infrastructure projects.

In 2020, we saw clear progress towards the 2025 goals. In Q4 2020, main shaft at the Kirovsky mine was put into operation, with works ongoing to complete another critical resource development project – construction of the first start-up facility for the tenth horizon of the Kirovsky mine (with commissioning scheduled for late 2021). The ambitious projects launched to upgrade the sites in Balakovo and Volkhov will help increase in-house concentrate processing volumes and boost mineral fertilizer output.

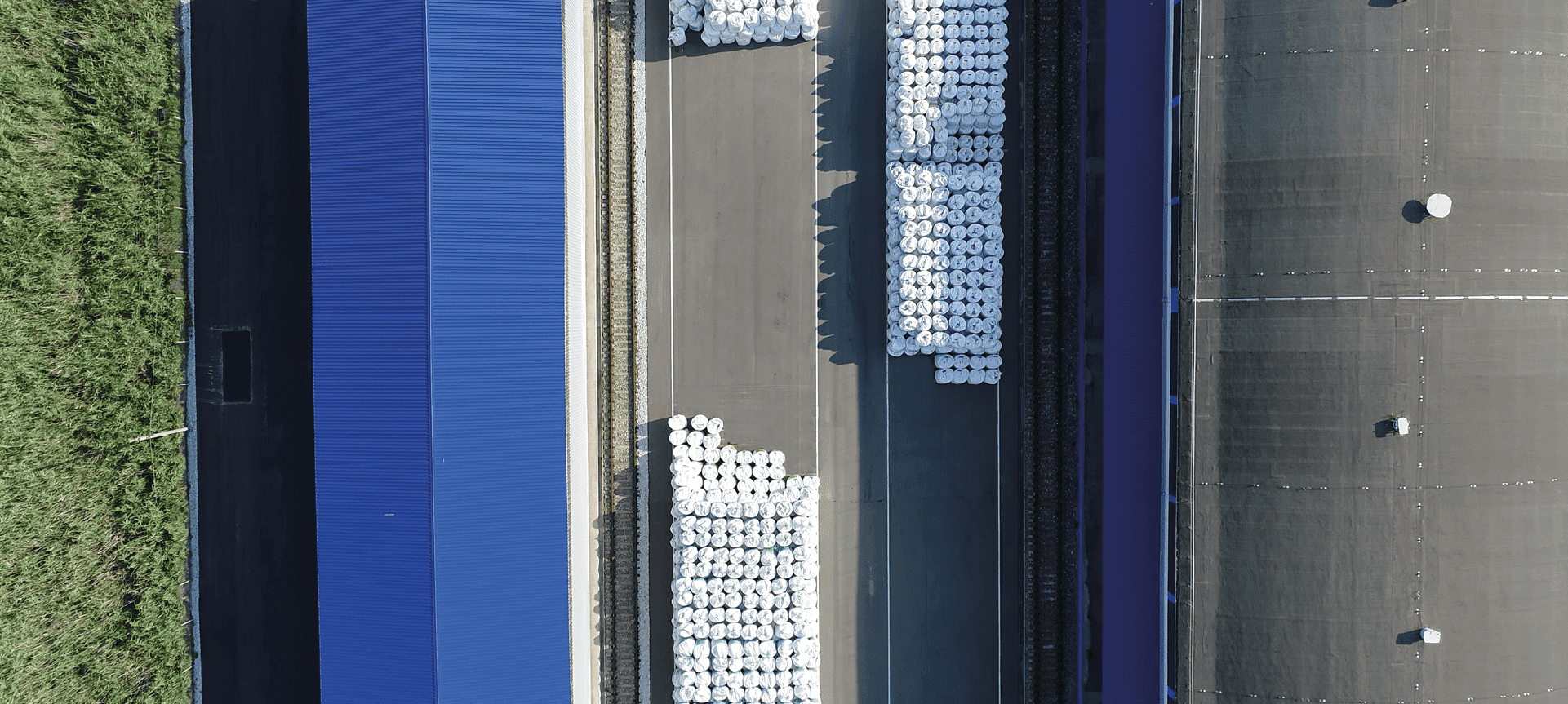

PhosAgro is actively developing its logistics chains in a bid to become closer to customers. In 2020, the Company achieved interim targets against such metrics as the number of distribution and logistics centres, and storage capacity for solid and liquid mineral fertilizers. The completion of construction and start of traffic service at the Kriolit railway station marked an important milestone on the path towards the key goal in the realm of logistics – expansion of the Company’s railway throughput capacity to over 16 mtpa. The Company is also firmly on track with other logistics goals from the Strategy to 2025, including acquisition of own rolling stock and development of port infrastructure.

Our objective is to set new standards for the industry in terms of product eco-efficiency as a way to promote public health, protect the environment, and prevent air and water pollution. We are integrating sustainability principles into all aspects of our operations. Adoption of the Climate and Water strategies in 2020 was an important step marking progress towards the ESG targets.

Sustainability is the core principle integrated into all lines of the Company’s operations

Sustainability principles are becoming a new parlance used by PhosAgro to communicate with all its stakeholders. In today’s world, the Company cannot develop its strategy and look into the future without having a clear understanding of the UN sustainability principles.

Strategy principles

STRATEGIC FOCUS AREAS

Strategic goals

Capacity expansion

Target values 2025

Risks

Mismatch between staff headcount and skills, and corporate needs

Failure to achieve targets under investment projects

HSE risks

Production process risks

Strategic goals

Higher self-sufficiency in feedstock

Target values 2025

Risks

Mismatch between staff headcount and skills, and corporate needs

Failure to achieve targets under investment projects

Strategic goals

Stronger operating efficiency

Target values 2025

Implementation of organisational projects with a high IRR (15% +) in line with the BAT and sustainability criteria Compliance with the CAPEX/EBITDA target and a comfortable net debt / EBITDA covenant headroom

Risks

Mismatch between staff headcount and skills, and corporate needs

Failure to achieve targets under investment projects

Strategic goals

Expansion of the foothold in premium markets

Target values 2025

to

Risks

Mismatch between staff headcount and skills, and corporate needs

Foreign sanctions imposed on the Group’s companies

Regulatory risks

Strategic goals

Higher share of premium fertilizer brands in the sales mix

Target values 2025

Risks

Production process risks

Strategic goals

Alignment of production and sales

Target values 2025

Risks

Failure to achieve targets under investment projects

Regulatory risks

Strategic goals

Reduction of per unit transportation costs

Target values 2025

Risks

Foreign sanctions imposed on the Group’s companies

Regulatory risks